New Zealand’s Past, Pūtea and Future: CBDC Vs. Bitcoin

Currently, there is global attention focused around the evolution of money. The trend of exponentially evolving technology is disrupting finance and governance is impacting all corners of the world.

In my home country of Aotearoa, aka New Zealand, the movement toward future money is palpable, from statements by the central bank (RBNZ) about re-evaluating money itself, to a movement toward Māori (indigenous) economic self-governance (tino rangatiratanga).

This article is about the future of money from a sovereign perspective. My aim is to show that New Zealand is not built on free market principles and in order for us to live up to the partnership envisaged from our founding document, the Treaty of Waitangi, Māori must be allowed to decide for themselves what currency and governance best satisfies their needs.

The Past

Independent authority (mana motuhake) and irredentism has always been at the forefront of Māori grassroots activism. For example, the infamous Hone Heke chopping down the British Flag staff, or King Tawhiao, the second Māori King (pictured above), leading a party to England to petition Queen Victoria in 1884 to create a Māori parliament and an independent commission of inquiry into land confiscations.

In 2014, the Crown acknowledged in court that Māori never ceded sovereignty, therefore, in order to be sovereign, we need a decentralized economic system and currency where no one can dominate it, otherwise we are subject to the Crown’s political and economic whims and short-sightedness.

The Māori relationship to NZ’s banking system has likewise been historically contentious and the following historical timeline exemplifies that. It is mainly compiled from the RBNZ.

Between 1830 and the 1840s: There was no “legal” currency in NZ, it was a free market for money where citizens had the optionality for storing, exchanging and measuring value. Different forms of money during this time derived their value based on their gold and silver content.

1840: The Treaty of Waitangi (Te tiriti o Waitangi) is signed by multiple tribes to set up a partnership with the colonial government where Māori retain their right to self governance (tino ranga tiratanga).

First bank established in NZ, the Union Bank of Australia, which began issuing notes from a shed in Petone, Wellington in March 1840. Notes were redeemable in specie (gold/silver).

1844 to 1845: First NZ paper currency in circulation that was not backed by specie but by legal authority. These “promissory notes” were removed from circulation in 1845 after being deemed illegal by British authorities.

1852 to 1856: A Government institution, Colonial Bank of Issue (CBI), was established and given a monopoly to issue notes backed by specie. The CBI was wound up in 1856 due to lack of confidence in the colonial government.

1856 to 1933: The free market for money returns and currency is issued by private banks, including: Bank of New Zealand, Bank of New South Wales, National Bank of New Zealand, Colonial Bank of New Zealand, Commercial Bank of Australia, Bank of Aotearoa, Bank of Otago, Commercial Bank of New Zealand and Bank of Auckland.

1861: The Bank of New Zealand is established by Royal Charter and Colonial Government legislation. Snoopman News noted: “The ambitious new bank cashed in on colonial parochialism by calling itself the Bank of New Zealand. It brokered finance of £3 million from the London and Sydney money markets to escalate the New Zealand Wars, after the Imperial Government’s terms were deemed too onerous and were declined.

“With a chronic case of ‘terrible twos,’ the Bank of New Zealand also bankrolled the Colonial Government’s overdraft while war was waged on Māori in the Waikato, and then the Bay of Plenty and the Taranaki and Whanganui regions.”

1914: Due to World War I, the requirement to convert notes to gold was suspended and never reinstated. All privately issued bank notes in circulation declared legal tender.

1933: Government instructs banks to depreciate NZ pound by 25 percent against sterling to “relieve pressure on exporters.”

1934: A New Zealand government official currency began life with the establishment of The Reserve Bank of New Zealand (RBNZ), it formed with sole right to issue notes and coins. NZ currency maintained legal convertibility to sterling.

1935: The first centrally-issued notes were authorized by the Reserve Bank Act 1934. The Reserve Bank was initially a private venture but was nationalized in 1936.

1933: The Reserve Bank of New Zealand Act established the RBNZ with monopoly powers of note and coin issue, with notes and coins to be legal tender, redeemable (in legal tender coin) and convertible (into sterling).

1938: The Sterling Exchange Suspension Notice was a regulation issued under the RBNZ Amendment Act of 1936. The convertibility requirement was dropped.

1964: The Reserve Bank of New Zealand Act declared that “legal” tender notes were to be issued solely by the Reserve Bank

Initially, according to the central bank, “the New Zealand currency had legal convertibility to sterling, but a growing sense of nationhood and economic independence led to the distinctive New Zealand currency of today.”

There were multiple attempts at national monopolism of the monetary system and the Bank Of New Zealand funded land dispossession from Māori to the Crown. Was the sense of nationhood growing for Māori?

Pūtea

Pūtea is the Māori word for gift. I’m using it here as a play on words to represent “the present.”

In the articles “Guardianship: The Māori World View of the Reserve Bank” and “The Journey of Te Pūtea Matua: our Tāne Mahuta”, the desire for Māori consultation in the economy finally becomes important. In “Guardianship,” Christian Hawkesby, RBNZ’s assistant governor, shared that “strong awareness of this [Māori inclusion] at the Reserve Bank is a basic part of our social licence to operate.”

The joint articles used Māori analogies and language (te reo) to explain its existence, such as:

- God of the forest (Tāne Mahuta). “The Journey” states that the RBNZ “became the Tāne Mahuta of New Zealand’s financial system, allowing the sun to shine on the economy.”

- -Guardian (Kaitiaki). “Guardianship” states that the RBNZ is the guardian of finance. But what exactly is it guarding? A throne fit for the Crown where its “legislated monopoly issuance of a local currency,” as described in “The Journey,” is now institutionally appropriated by benevolent naming.

- -The prime source of finance (Te Pūtea Matua), translated in 1988 by the Māori language commission and not put to use until June 13, 2012 when it was used as the official Māori name for the Bank.

Te = The

Pūtea = Gift (money / finance)

Matua = Respected male elder (parent), senior, main or primary.

With the Māori terminology having multiple meanings depending on the context, the RBNZ translates “The name of the Reserve Bank in Māori is Te Pūtea Matua. This literally means the parent or guardian of all the money.”

This is different to how it was translated earlier, which was as the “prime source of finance” as it uses the parent or guardian translation instead of the main or prime.

While I do agree that the partnership has not been upheld and that we should incorporate more consultation into the partnership’s decision making and Māori language to explain it, I don’t believe central banking, a colonial and Marxist tool that increases inequality, is worthy of being referred to god-like deities within the Māori lexicon.

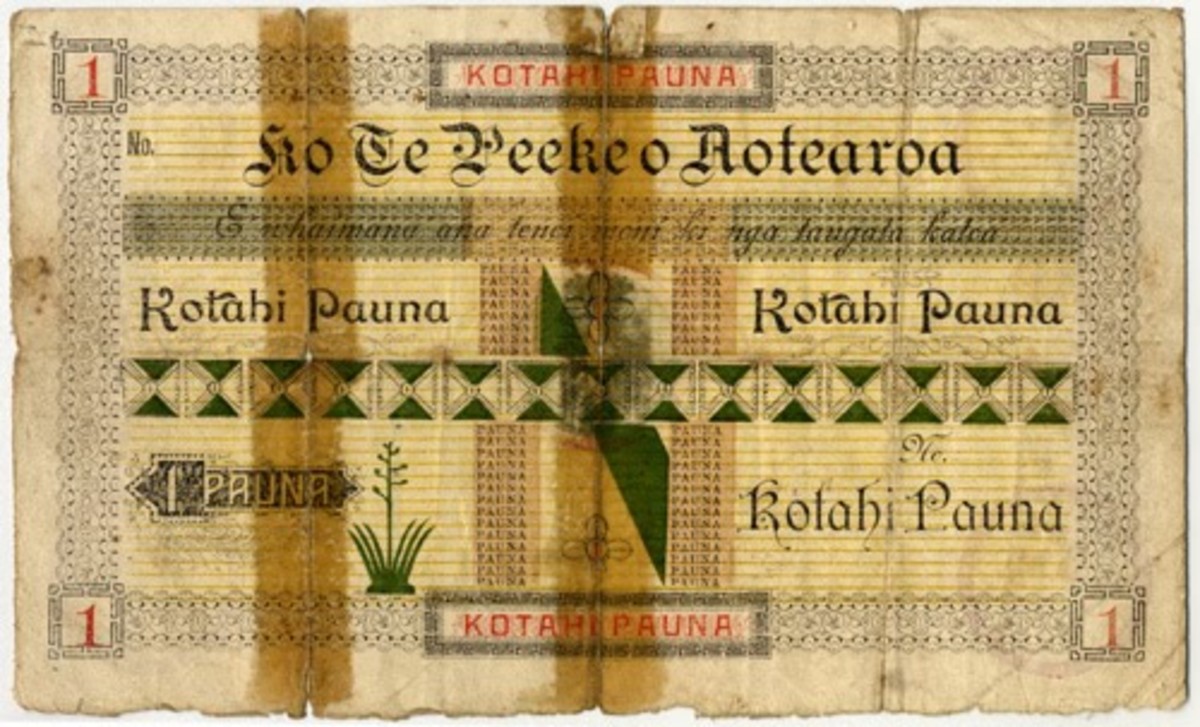

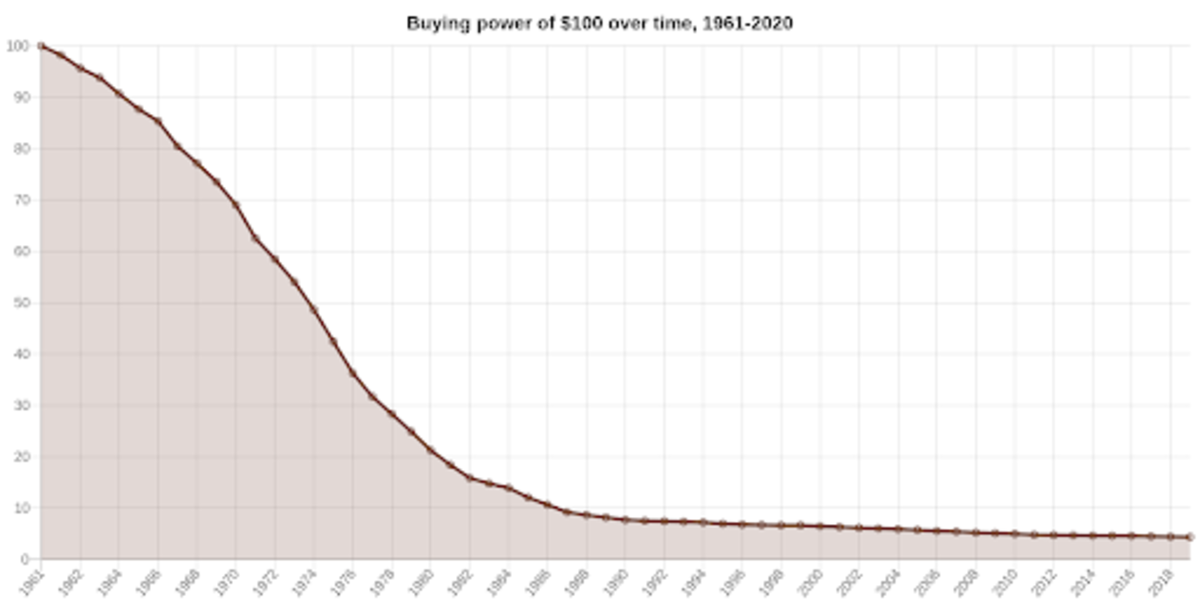

Would you call the NZD, as shown below, a gift?

I would argue that Pūtea has to be founded by the people operating in a free market. It is contradicting to say that the NZD is a gift when it continually loses purchasing power and has to be enforced from legal tender laws so that the Crown can retain a monetary monopoly.

Free market definition: Any market in which trade is unregulated; an economic system free from government intervention.

According to the NZ treasury: “New Zealand has an open economy that works on free market principles.” But this is an outright lie.

The terminology is absolutely toxic to an understanding of economics, as wealth is not a gift bestowed upon the population by the monetary printing press, but rather by the creation of value from individuals interacting in an infinitely complex network. The idea of wealth as a gift from above is a slave mindset — being fed crumbs from the master’s table.

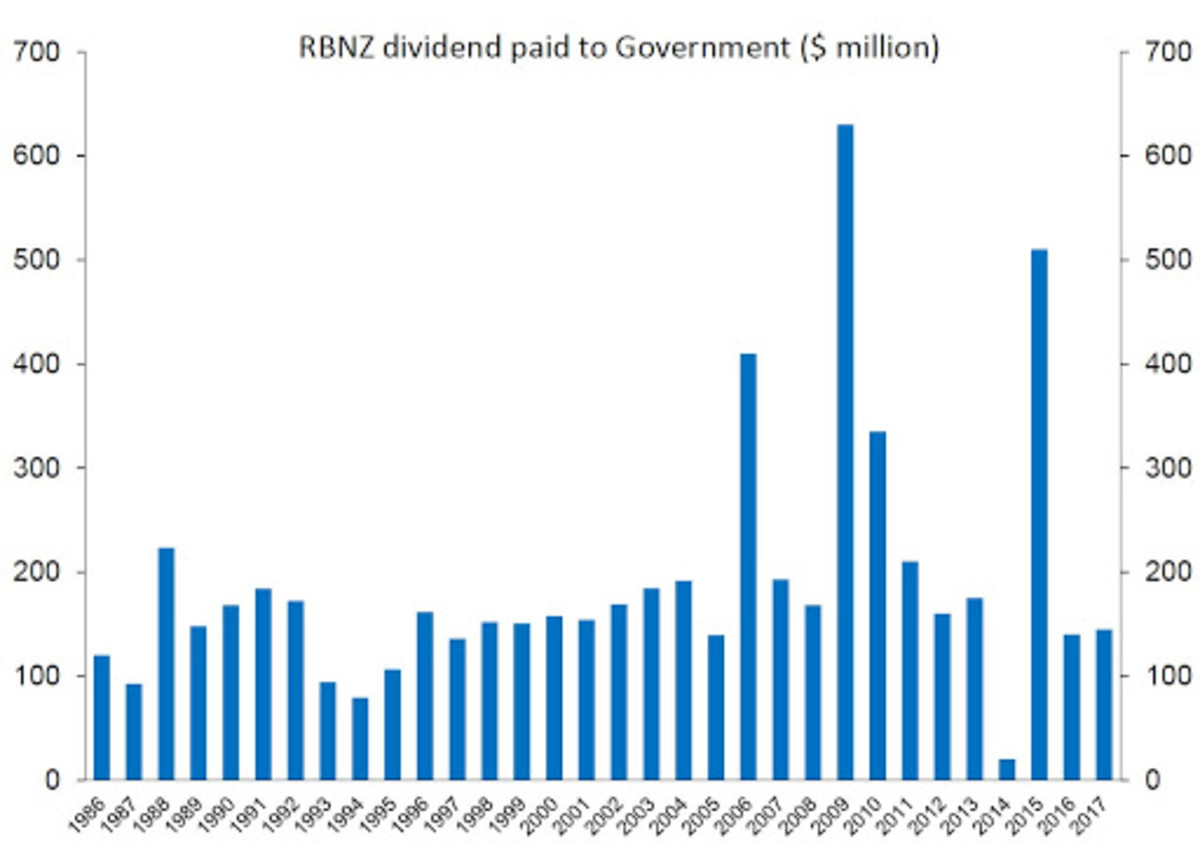

Are the actions of the central bank befitting of the title of respected elder?

By design, central banking establishes the Crown’s dominance through “legally” enforcing the monopoly on money and enabling the Crown to fund its deficit spending beyond the revenue they accumulate in taxes. Should we really, as Māori, be glorifying or normalizing this centralized colonial power structure?

As highlighted earlier in the historical timeline, the Colonial Bank of Issue (CBI) established a monetary monopoly which wound up in 1856 due to lack of confidence in the colonial government. After that, there were the land wars. This makes me wonder what happened between then and 1934 to restore trust and allow the Crown to once again establish a monetary monopoly.

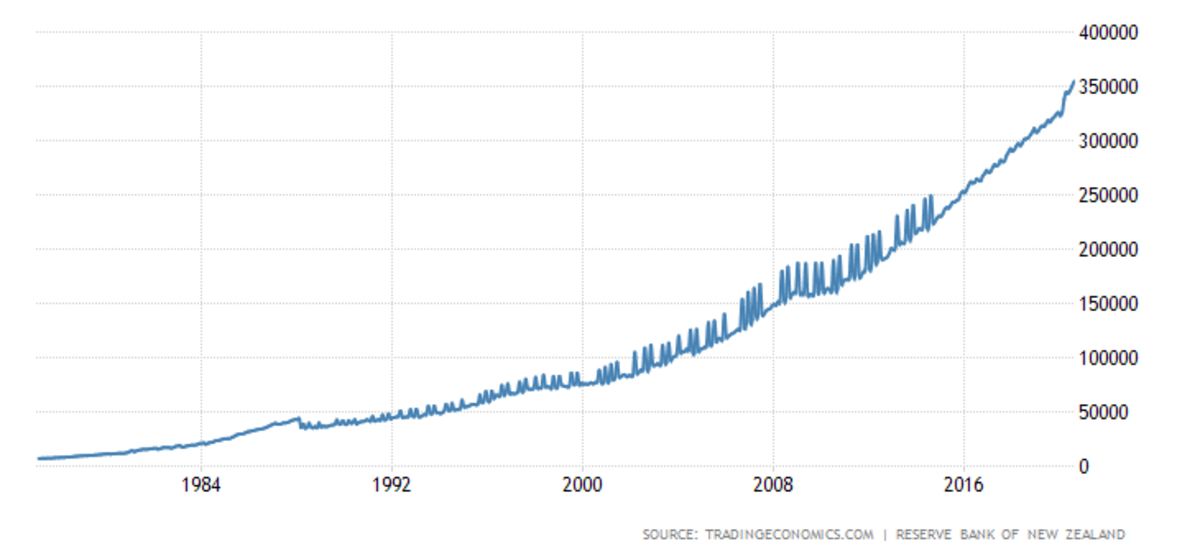

Funding the Crown’s deficit spending is at our expense, as perpetually increasing the total supply of the currency dilutes our stored wealth, which is known as “currency debasement.” It enables the crown to use the new base money with a higher initial purchasing power, this purchasing power decreases with every transaction as the market accounts for monetary inflation, known as the Cantillon Effect.

This increases future taxes for our future generations because money is brought into existence through a debt-based system.

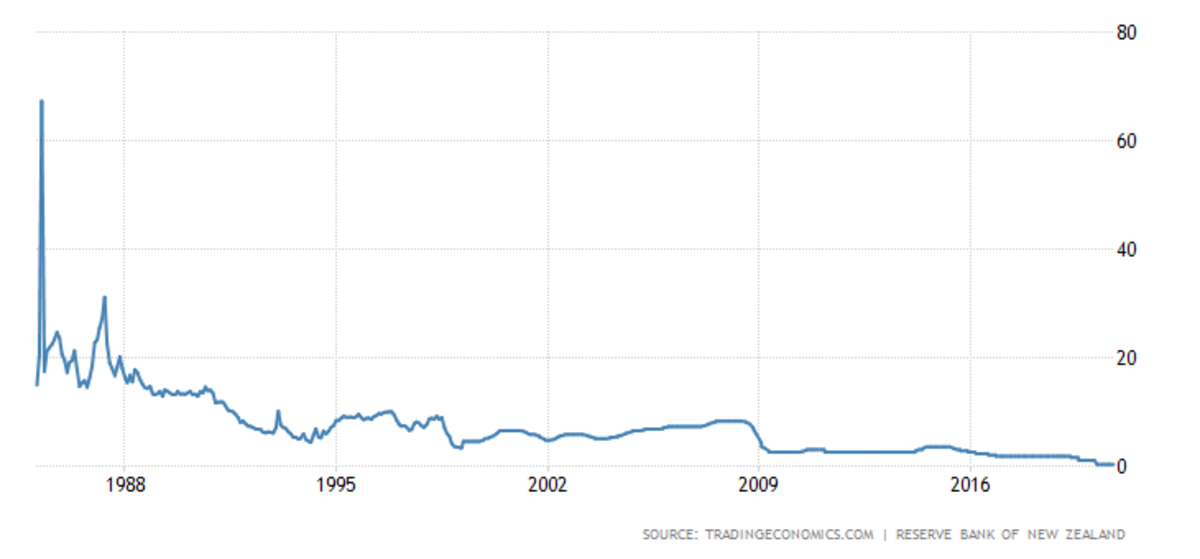

Additionally, annually compounding interest historically negated the loss of purchasing power from the inflating monetary base but interest rates have been continually dropping, which were the incentive to save in dollars to earn annual compounding interest.

New Zealand’s central bank was the “first central bank in the world to adopt inflation targeting in 1989,” according to “Guardianship.” “By creating an environment of low and stable inflation, we aim to give New Zealanders the confidence to make long-term plans for their lives.”

The issue with the inflation mandate for price stability — which, again, contradicts free market ideology — is that it’s only focused on a changing basket of goods selected by the Crown.

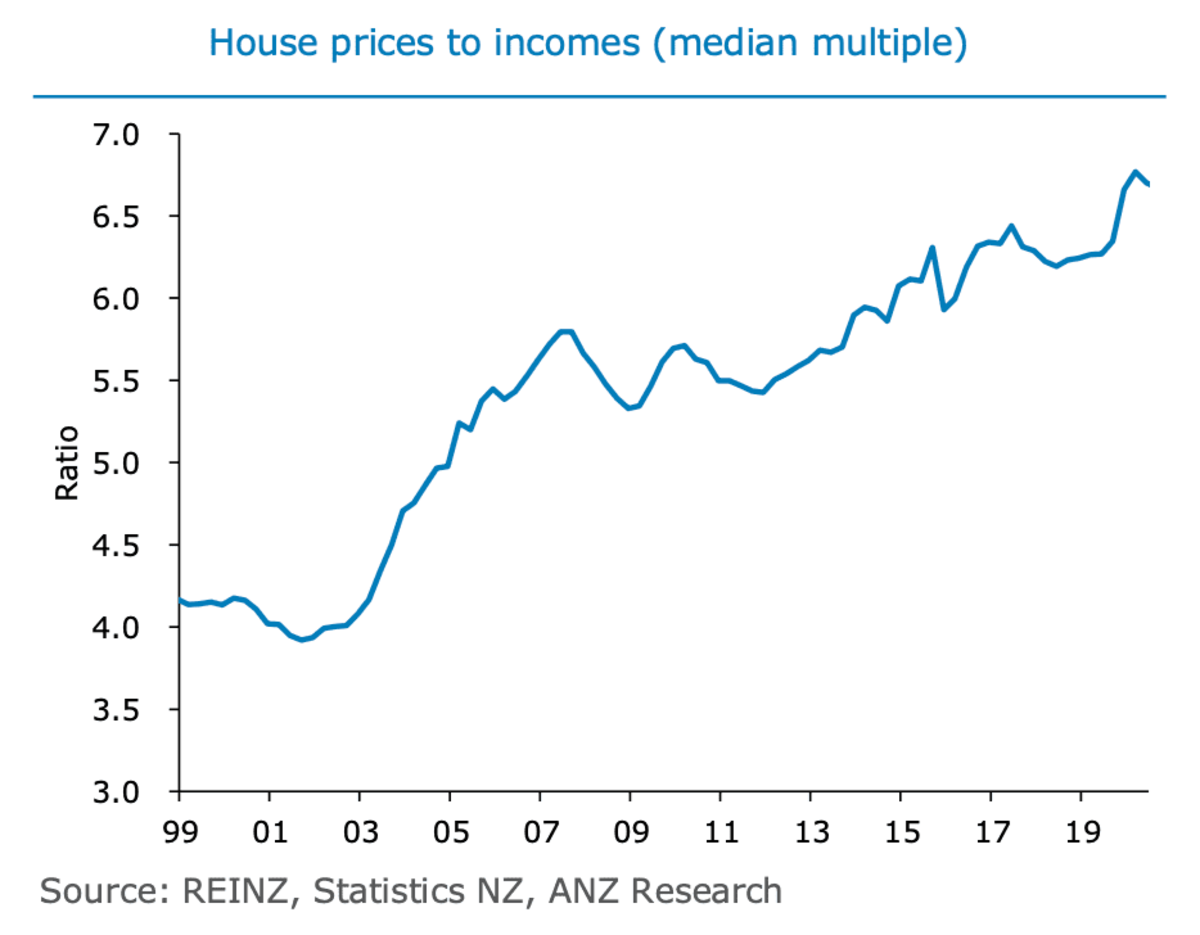

Does long-term planning include owning your own house? Why is that not part of the basket?

The Real Estate Institute’s (REINZ) chief executive Bindi Norwell noted that November 2020 would be remembered “As being the point in time when Auckland region’s median house price hit the million-dollar mark… something no one anticipated or expected.”

When the “gift” is no longer a good medium — a long-term store of value — of course people are going to seek yield in other markets, housing being one of the more simple markets for the average Joe in contrast to stocks or bonds. As Alan Greenspan put it “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.”

So where does this leave us moving forward?

The Future

King Tawhio’s petition to establish independent Māori governance systems was referred back to the New Zealand government by the Queen, and the government dismissed Māori needs back then. Now, thanks to defensive technology such as cryptography, Bitcoin gives optionality for a decentralized governance and monetary system moving forward, one that can’t be dismissed because it is permissionless and resistant to censorship.

The trend toward future money is shown clearly in recent articles from the Reserve Bank of New Zealand (RBNZ) and by central banks worldwide exploring Central Bank Digital Coins (CBDCs).

In “Banking the economy in post-COVID Aotearoa” and “Reserve Bank seeks to preserve benefits of cash,” the RBNZ highlighted certain key observations about the effects that financial technologies, led by Bitcoin, are having on legacy systems.

Statements from these articles include:

- “FinTech presents both risks and opportunities for banks, and broader monetary and financial stability, and cuts across a number of Reserve Bank functions. This is not academic, it is happening now.”

- “Banks’ business models and products must become more customer centric or FinTechs will expand at the banking system’s expense.”

- “In the years ahead, some of the biggest questions facing central banks could well be around the future of money itself”

It is clear that the traditional financial system is being disrupted and must adapt with the fintech revolution or face being out-competed and phased out.

The RBNZ is not necessarily opposed to this fintech revolution, but it has signalled that the commercial banks have a current advantage and will not be bailed out.

“The Reserve Bank is not guardian of the status quo,” per “Banking the economy in post-COVID Aotearoa.” “Whilst FinTech disruptors could weaken bank profitability and create transitional risks, ultimately the Reserve Bank supports a dynamic financial system focused on improving outcomes for customers and financial system participants. Commercial banks start with the advantage of established customer relationships and a prevalence of accumulated data. Whether banks embrace the opportunity of open data, or resist innovation and are competed away by emerging FinTechs is up to them.”

Controversially, the RBNZ is simultaneously exploring a Central Bank Digital Coin (CBDC), which would compete directly with the entire private banking ecosystem.

“Looking forward, we remain open minded about how the technology of money and payments will continue to evolve,” RBNZ Assistant Governor Christian Hawkesby said. He added that “central banks around the world, including the Reserve Bank, are researching retail CBDCs. Although we have no imminent plans to issue a CBDC, we are well-connected and considering these developments very closely.”

An important question is: Can the private banks compete with a CBDC? And how?

The trend emerging is that the centralized legacy system is outdated regarding technology, and fiat is outdated as money, given that it is a poor store of value which is a critical monetary function. Here are the signals backing my view:

- RBNZ Chief Economist Yong Ha, talking about negative interest rates, has been quoted as saying: “We acknowledge asset prices will rise and house prices are the key one.”

- The International Monetary Fund recently suggested that it’s time for a new Bretton Woods Movement.

- RBNZ Governor Adrian Orr and Chief Executive of Power Finance Dave Corbett have said: “We’re talking about a sovereign-backed digital currency that we built for New Zealand.” And “The Power Dollar is both a store of value and an enabler of payments. It is essentially a sovereign-backed smart money, one-to-one backed to the New Zealand dollar and will be held by the Government which has credit ratings of AAA and AA+.”

Apparently there is a currency battle taking place for the future of money and who gets to be the usurer.

CBDCs, such as the asset created by Power Finance, are not reinventing the wheel in regards to the store of value functionality, the Crown will still be able to “print.” Central banks, like many other fintech applications, are trying to extract and utilize blockchain technology in an attempt to replicate the success that bitcoin has had as the best performing monetary asset over the last decade.

What most central banks and governments have not figured out though, is that the value is not derived from “blockchain technology” alone, which Bitcoin birthed.

“The reality is, that a ‘blockchain’ is just a kind of slow, inefficient, distributed database,” as Ben de Wall wrote. “Everything that makes Bitcoin’s blockchain interesting is the technology around it: Decentralisation, proof of work, economic game theory, and the absolutely brilliant concept of the mining difficult adjustment to set a kind of clock that adds a new kind of ‘fairness’ to the system that has never been seen before. With these, a blockchain is an important part of a technological marvel; without them, it’s just a slow, inefficient database.”

The entire purpose of a blockchain data structure is to enable decentralized control, and so is nonsensical when deployed by a central authority.

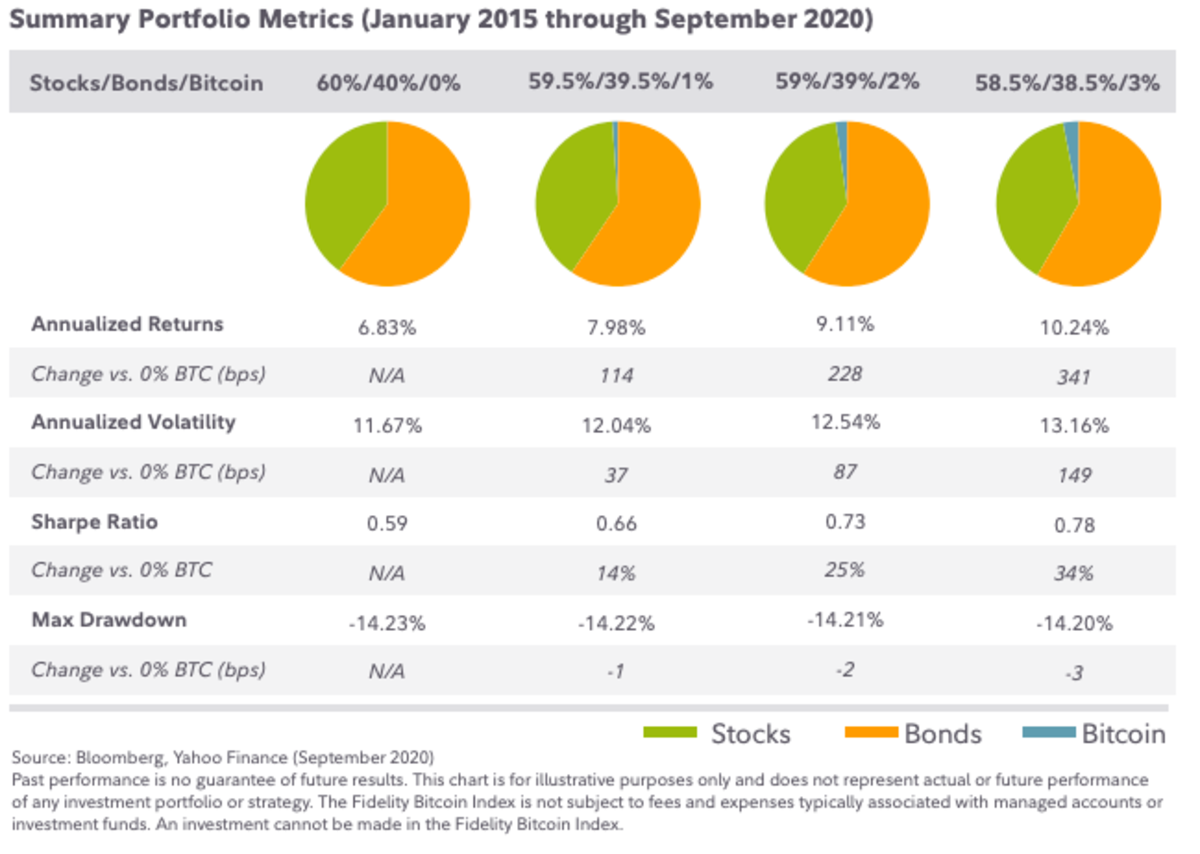

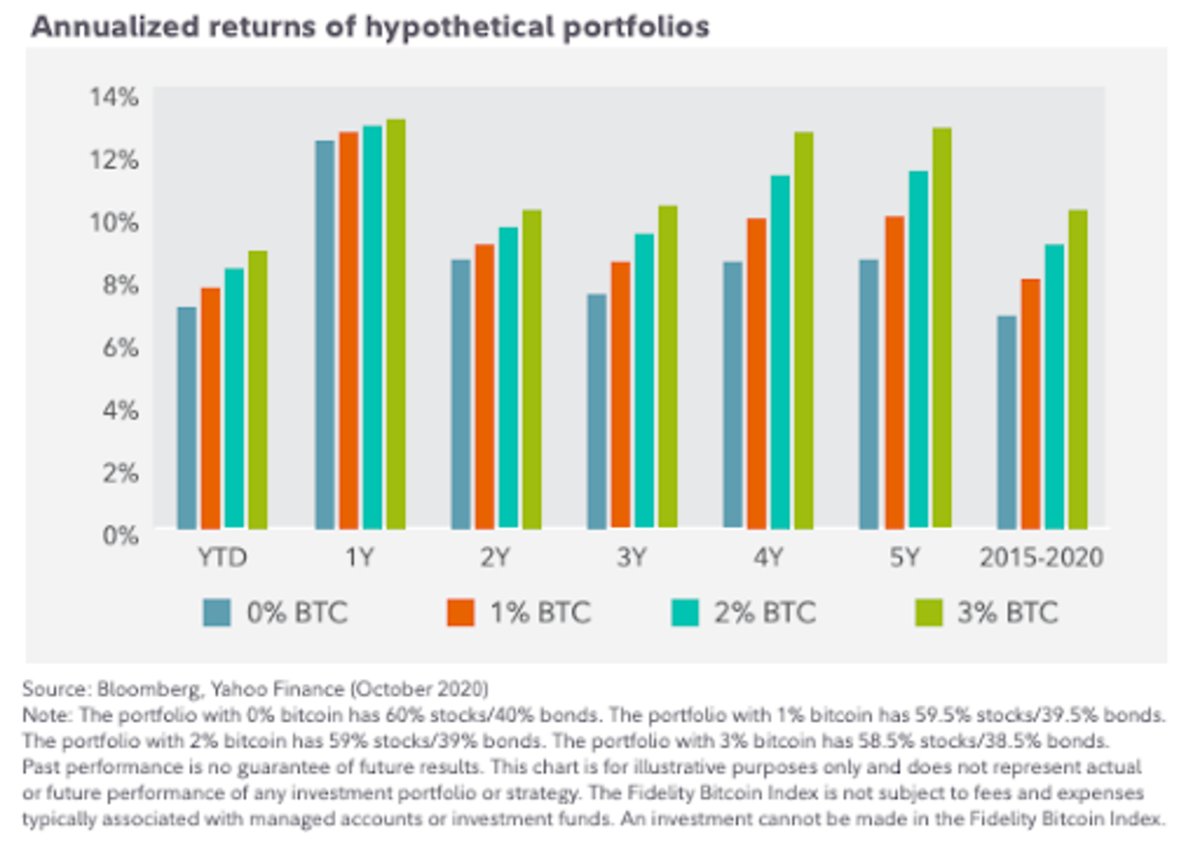

Fidelity, a multi-trillion dollar asset management firm in the U.S, understands the bitcoin (not blockchain technology) value proposition from an institutional perspective and recently released its second investment thesis on bitcoin:

As it highlighted: “In the current economic environment where investors are worried about the lasting impact of the pandemic, unprecedented quantitative easing and other central bank intervention, and historically low interest rates on public equity and fixed income markets, identifying alternative sources of return has become paramount.”

Showing that regardless of volatility within the emerging asset class, a non-zero allocation is beneficial to each and every portfolio.

“Investors may use alternatives to fulfill one or more roles in a portfolio,” Fidelity explained. “Broadly, these roles include diversification, risk reduction, return enhancement, and yield or income generation.”

There has been talk about creating a Māori cryptocurrency for economic tino rangatiratanga (self governance). While I am open to being wrong, the game theory suggests that Bitcoin is our best chance to facilitate that.

Why?

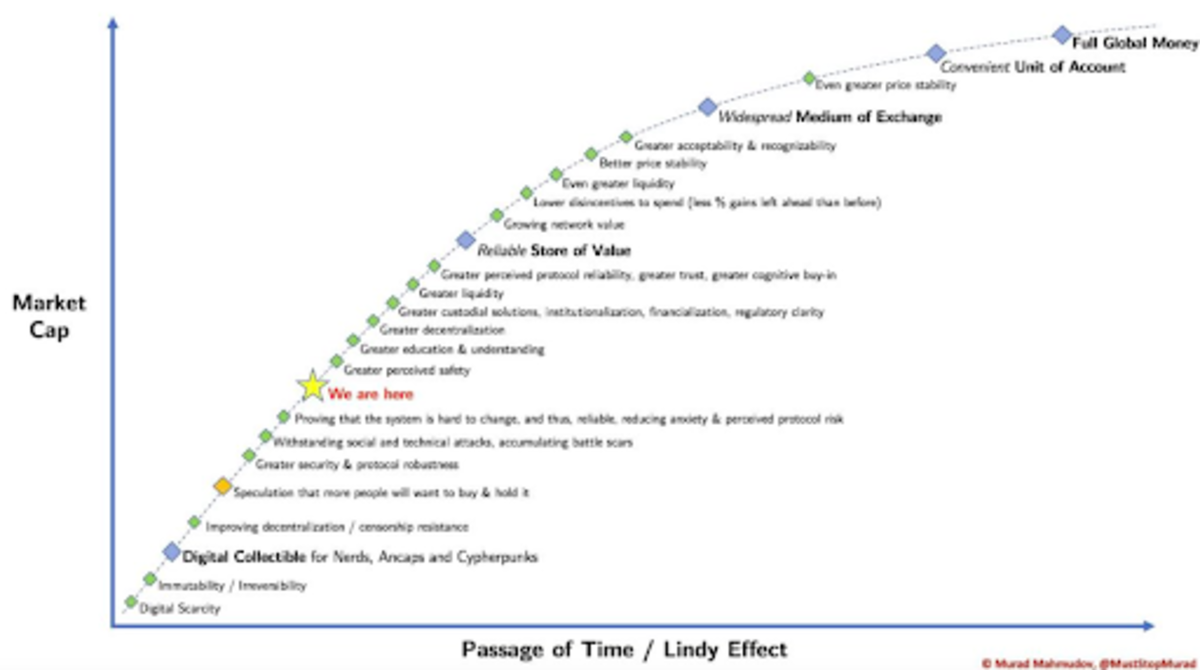

Nick Szabo’s piece “Shelling Out’’ highlights the monetization process for an asset; starting as a collectible and growing into a widely known store of value which then becomes a medium of exchange as the assets liquidity increases. Once widely used for both of these functions, it finally becomes the measuring stick, a unit of account. Throughout this process the asset is competing with other monies and people inadvertently converge to the best money to store their value.

Given that the first step is becoming a widely-known store of value, any competition has to provide more of an incentive than bitcoin to warrant storing value, if it can’t provide a better incentive then people will converge to the better medium: bitcoin.

Just like the failed e-currencies before bitcoin, fiat suffers from the same issue, as pseudonymous Bitcoin creator Satoshi Nakamoto simply put it: “A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.”

Or, to delve a bit further, Unchained Capital’s Parker Lewis wrote:

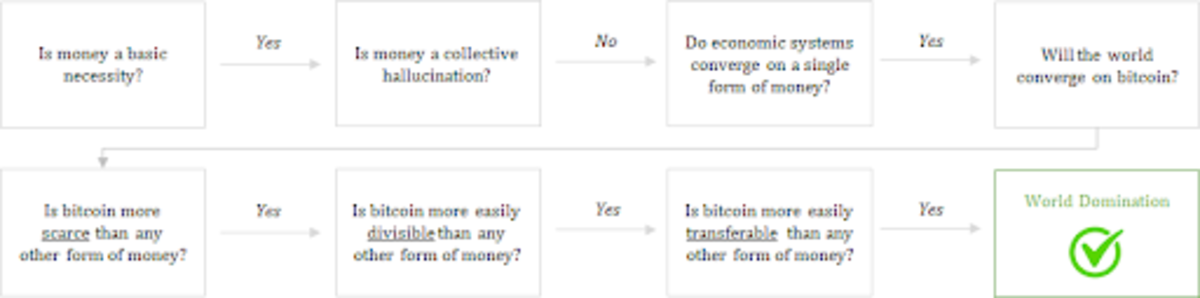

“If any individual comes to three principal conclusions: i) money is a basic necessity, ii) money is not a collective hallucination and iii) economic systems converge on a single medium, that individual is going to more consciously seek out the best form of money.

“It is money that preserves value into the future, and ultimately, allows individuals to convert their own time and their own skills into a range of choice so great that prior generations would find it difficult to imagine. Freedom is ultimately what a reliable form of money provides: the freedom to pursue individual interests (specialization) and the ability to convert the output of that value into the value created by others (trade). Whether individuals consciously ask themselves these questions or not, they will naturally be forced to answer them through their actions. They will also arrive at the same answer as those that do.”

Some tend to focus on medium-of-exchange attributes and functionality (payment speeds or costs) as if they are mutually exclusive from the store-of-value function. As we now know, the store-of-value attributes and functionality are the first hurdle. The latter can be altered and experimented on in various secondary layers, but if there is no scarcity and demand to warrant storing value, then there is no need to exchange worthless tokens. This is simply payment processor narratives, not currency competition because no one will store alpha within. It’s monetary Darwinism.

If we were to try to create our own currency we would need to consider demand and the network security. Who will build it and be early entrants? Different tribes (Iwi) didn’t agree to unite under King Tawhiao’s authority back then, I’d imagine it would be similar today.

Could it incentivize distribution enough to be decentralized, or will some central figure have admin keys? Will it be scarcer than bitcoin and therefore a better store of value?

For now, bitcoin is the only serious option.

I hope this further opens the dialogue for different monetary options in the future. More competition makes the market freer, which provides better solutions and allocation of capital, bringing more freedom and prosperity as a result. Stop swapping your time, energy and hard work for something you don’t understand.

Kā tapu waewae o mātou tīpuna — The sacred footsteps of our ancestors. Free, sovereign.

This is a guest post by Ben Jarvie. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post New Zealand’s Past, Pūtea and Future: CBDC Vs. Bitcoin appeared first on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/32VUBRU

No comments