What Are The Leading DeFi Tools And Services In 2020

Should DeFi (decentralized finance) need an explanation, I’d say it’s an economy where you and I get to decide what is what.

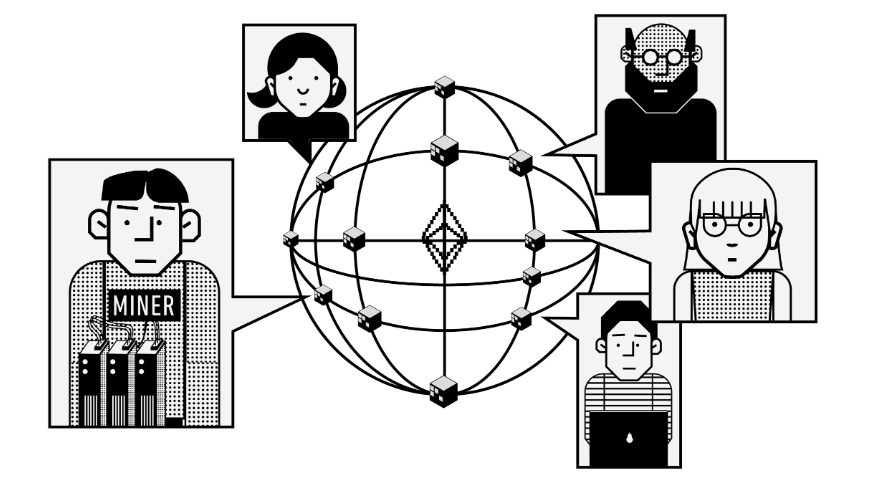

In grandma’s terms tho, the DeFi ecosystem is a network, usually powered by blockchain architecture, where open-source software in the form of programmable and autonomously executable smart-contracts, which on their own turn, are operated without human interference and without the unnecessary intermediaries that tend to leech off your transactions.

A paradigm as expressed by Block123 says that decentralized finance impacting the financial world the same way that open-source software has changed software products.

Now, since DeFi is relying on the succession of smart-contracts, it should be natural that the public and decentralized Ethereum blockchain is leading the space with a difference in terms of market adoption, utility, and growth opportunities.

Yet many popular blockchains, whether hailing from Ethereum, as in forked from it, or standalone distributed ledger networks are now jumping into smart-contracts in an attempt to stay competitive in this cutting-edge crypto trend.

Assuming that you theoretically comprehend the core concept of DeFi in a level of noncustodial exchange of assets and ownership contracts, we’ll take a look at some practical examples by investigating some of the most popular DeFi projects, in order to showcase what a day in the DeFi ecosystem looks like for crypto locals.

Relevant Article: These Are The Leading Blockchain Use-Cases Across The Globe

What’s There To Do In DeFi (Why Should I Care?)

Since Decentralized Finance is more of a philosophy that is subject to its technicality, it could be considered as a protocol or a framework, on top of which various DeFi projects could be deployed and running.

Hence, when we talk about DeFi, we’re not necessarily speaking about a specific thing and/or project, although some ventures such as MakerDAO, and 0x Protocol have been the DeFi symbols since the beginning of this yet pact scene.

So how do we spot a DeFi project as total noobs? I mean, what is DeFi, and what is not? For starters, you’ll be able to notice the labeling, having in mind projects in the DeFi ecosystem are most likely to use the term for promotional reasons. Being in DeFi and missing mentioning it would suggest that something’s not well proportioned.

Of course, when diving into DeFi you’re probably already looking to leverage edge financial tools and not trying to buy cookies, so even tho DeFi projects can differ in nature, what’s common is the fact they enable exactly what DeFi suggests: A Decentralized Financial System.

One could argue saying that cryptos were decentralized all along, even before DeFi was invented as a concept, and that would be partially true.

The thing with cryptos before DeFi was that you could use your Bitcoin (BTC) in a peer-to-peer fashion, as long as you know your trading partner, you have his public address, and most importantly you trust him.

Imagining how that would be impossible to support a globalized decentralized payment network, we started to see cryptocurrency exchanges of the likes of Coinbase, and Binance popping out at a period where crypto traders couldn’t trust outdated crypto exchanges that looked like they just got out of the dark web.

Sure, the above exchanges solved some security issues with p2p crypto trading, yet they failed to fulfill the initial Satoshi’s vision. becoming some sort of centralized points of exchange in the sphere.

By that, I mean that Binance is cool and everything, yet, I am not eligible to own my wallets on their homonymous exchange, but in fact, I am allowed to use their custodian wallets when topping up my Binance pouch.

In simpler words: Binance allows you to exchange your cryptos, but not in a p2p fashion. On the contrary, it acts like an intermediate authoritarian party that makes sure everyone gets what he wants, for the price he wants, as long as using the Binance platform to perform the transactions, and of course by paying some fees to the company behind the easy to use exchange market.

So what happens if I want to use my crypto when Binance is offline or under maintenance? Quick answer: you don’t. Exactly because all operations using Binance’s native wallets rely upon the gigantic central legal entity that Binance managed to become.

In addition, you can’t always send ERC-20 tokens or other token standards like ERC-721 non-fungible tokens and other crypto collectibles to your Binance Ethereum wallet since you practically can’t access it in a web3 manner, but only through Binance’s platform.

To demonstrate how DeFi differs both when compared to a centralized financial system as well as a custodian one, I’m laying down a sketch of a typical DEX’s (decentralized exchange) prospects:

Centralized:

- The central bank owns, manages, and is eligible to promote or seize your transactions, assets, and funds.

- Nonnegotiable. Subject to sudden shifts in rates, supported services, economic policy, and overall governance.

- You can engage in exchange with whoever the central financial institutions finds legit according to their own agenda and set of internal rules. You can send money to an analogous bank and receive money from an analogous bank. That’s it. A closed network of finance.

Read More: Thailand: Ministry of Finance To Tokenize Over $6.4mn Worth Of Bonds

Custodian:

- The custodian exchange owns, and it is eligible to promote or seize your transactions and funds. You manage your funds as long as the respective exchange is online and properly functioning. You can’t store assets such as smart ownership contracts, and crypto collectibles on a Custodian exchange.

- Negotiable, yet can be subject to sudden server issues that wouldn’t allow you to access your funds during the period of a potential maintenance and/or system upgrade.

- You can engage in exchange with the custodian market owner which acts as a pool for decentralized crypto traders from all over the world. You never engage in a p2p trade, as the market is always the third party that ensures you get the liquidity you need, at the price you’ll set, and at the trading pair of your choice.

Decentralized:

- You own, manage, and are eligible to promote or seize your transactions, assets, and funds.

- Negotiable, as in you decide how many fees you’re willing to spend in terms of GAS at each transaction. Always accessible and viable as long as you own your seed phrase and/or private keys, and will never go offline as long as the blockchain the wallet belongs to is nominal.

- You can directly exchange monetary and other digital assets in a wallet-to-wallet fashion using automated smart-contracts. That means that if I want to sell an asset or buy an asset I could easily list it using a DEX, or make a bid to the owner directly. From that point, a smart contract is deployed and makes sure that when the first trader who is looking to fulfill my requests is found, my contract will be fulfilled, and without any intermediary. No banks, no custodian exchanges.

If that doesn’t answer the question “Why One Should Care?”, I suggest you get some crypto 101 tips before diving into DeFi.

Read More: Deloitte: Over 1/3 Of Global Companies Are Integrating Blockchain

The Projects That Spearhead The DeFi Revolution

From liquidity protocols, and lending platforms, to CDPs (collateralized debt positions) and w2w (wallet-to-wallet) exchanges, the DeFi ecosystem has a plethora of projects that have their own pros and cons in different categories of decentralized finance.

MakerDAO

MakerDAO is probably one of the most important DeFi aggregators, being the project behind DAI (multi-collateral DAI), an Ethereum-based stablecoin, backed by Ether (ETH) itself, Synthetic tokens such as Wrapped Ether (WETH) and other ERC-20 tokens including but not limited to Basic Attention Token (BAT).

DAI, previously SAI (single collateral DAI backed solely by ETH is discontinued to avoid market manipulation practices), on its own is one of the most important catalysts of the Decentralized Finance ecosystem.

Not only it is the first stablecoin backed by cryptocurrencies as collateral, but it is also the first stablecoin that is funded by anyone interested in generating some DAI by locking up ETH or other substitute tokens of the Ethereum blockchain.

DAI doesn’t belong to a legal entity, as happens in Tether’s case (USDT), which is supposed to be backed by a basket of fiat currencies owned by the company – something that could never be confirmed – but instead, it relies on a series of sophisticated smart contracts and a collateralization process that’s crystal clear and transparent for anyone to see.

In essence, you lock some ETH, and you generate an equivalent amount of DAI in terms of monetary value. You can unlock your ETH, when the amount of DAI issued, in addition to a small interest rate, are posited back to Maker.

Basically, if you choose to lock $1000 worth of ETH, you can generate/issue something around $500/600 in DAI, which you can use however you see fit.

High-frequency traders and smart contract developers are cracking on collateralized ETH, since managing to grow your DAI through trades and/or other financial processes will compensate you with arbitrary opportunities. (eg. You grow your DAI to 800, pay 505 to get your ETH back, you’re left with $1000 worth of ETH + 295 DAI).

*The above figures are estimated based on MakerDAO’s current collateralization ratio that sits at 200%.

If you’re not sure how to grow your DAI, there are various platforms, including MakerDAO itself, where you can lock your DAI or ETH and earn interest over time, similar to the good old traditional banking days. Some popular mentions include Compound and Fulcrum.

Keep in mind that DAI might be the most popular product of MakerDAO, yet it is far from the only one. To learn more about MakerDAO, and MKR governance token, consider taking this pit stop.

Besides DAI, another of MakerDAO’s highlights would be Oasis, where web3 netizens can easily trade, borrow, and save Ether, and Ethereum-powered tokens on spot, all with the ease of their own web3 wallet.

DAI is considered the standard stablecoin in the overall Ethereum ecosystem and any dapp, or DEX involved in sub-Ethereum asset exchange would typically recognize and utilize DAI as casually as ETH itself.

Read More: How To Promote Crypto Adoption Without Crypto

Uniswap

Most likely THE most popular decentralized exchange (DEX) out there, Uniswap stands tall to its title, showcasing daily volumes that would sometimes surpass those of centralized and custodian exchanges, including Coinbase.

In a nutshell, Uniswap is an open-source decentralized protocol for automated liquidity provision based on the Ethereum blockchain. It allows anyone to provide liquidity powered by their own assets.

Every time you’re trying to swap your Ethereum-based tokens for analogous digital assets, Uniswap will find the most suitable wallet that has decided to sell/trade the asset you’re looking for in exchange for the asset you’re willing to part.

Fees? Typical Ethereum network GAS-fees are applied, yet if the DeFi project is aggressive when it comes to profitability, you could see additional fees for liquidity providers and network fees. Still, that’d be something around $0.20 to $1.5 compared to the not so low-ki $5-$10 deposit and withdrawal fees associated with custodian crypto exchanges.

Besides providing liquidity for thousands of traders worldwide, Uniswap offers APIs used by hundreds of decentralized applications that need constant liquidity to cover their respective customers’ demands.

As of today, over $74,5 million worth of digital assets are locked in Uniswap liquidity pools, while the TVL (total value locked in terms of USD) in DeFi is sitting at an astonishing $3,98 billion cap, according to DeFi Pulse.

Uniswap inspired a plethora of analogous exchanges that become a thing on their own, and that’s part of the open-source, decentralized, and transparent magic.

0x Protocol

DeFi is cool and all, but it would be nearly impossible without infrastructure providers such as 0x, the first and largest open protocol that enables wallet-to-wallet cryptocurrency and digital asset exchange on the Ethereum blockchain.

Although not very popular on the surface, it is most likely that some of the dapps, and/or DEXs you’re using are relying on 0x to offer their respective financial services.

Basically a 0x API automatically creates orders that can be interactive with your smart contracts before registered on-chain. With 0x you can easily launch your own token swap protocol, similar to Uniswap, and subject digital assets of the likes of collectible tokens, virtual art, and in-game wearables.

For professional DEXs, 0x offers unparalleled liquidity sourcing from a plethora of successful and popular DEXs, and liquidity pools. That means that the 0x API will allow your smart contract to scan the desired pool of liquidity providers before settling with the one that offers the best price for the token swap of your choice. Now that’s some next-level DeFi.

Not only 0x allows you to pick the best price but it also enables cross-platform swaps, meaning that your order could be periodically filed by two or more different liquidity providers such as Kyber, and Uniswap at the same time.

Practically, one could say that 0x is the backbone of DeFi, at least when it comes to token swaps, and wallet-to-wallet exchanges, which pretty much make up the core of the DeFi ecosystem.

In addition, 0x has its own native cryptocurrency ZRX, and it recently launched Matcha, an intuitive DEX with slick UI/UX, one that showcases what’s possible with 0x APIs. For me, it might just be the DEX of choice for 2020-21.

Smart-Contracts Related Content: IBM To Offer Decentralized Smart Contracts Through Hyperledger Fabric 2.0

Wrapped Bitcoin (WBTC)

After the succession of Wrapped Ether (WETH), which is undeniably more popular than ETH itself in sub-Ethereum cultures, we got Wrapped Bitcoin (WBTC), and yes, it is exactly what it sounds to be.

In machine-gun speed, wrapped tokens are basically pure or synthetic tokens that follow the ERC-20 token standard. Their purpose is simple: simulate the price of the underlying asset, yet avoid its network fees, and congestion traffic, by using the Ethereum blockchain instead.

Similar to stablecoins like USDT, WBTC is also pegged to a currency, in this case Bitcoin (BTC), meaning that 1 BTC = 1 WBTC. The value proposition here is the fact that you can use WBTC as a regular ERC-20 token, able to be staked, swapped, lend, and used in all sorts of DeFi services and tools as a catalyst without worrying about Bitcoin’s slow and expensive transactions.

Furthermore, WBTC facelifts Bitcoin to the ERC-20 standard, making it possible to write smart contracts that integrate Bitcoin transfers. If you don’t see the value here, just wait for it.

In order to receive WBTC, a user requests tokens from a merchant. The merchant then performs the required KYC / AML procedures and verifies the user’s identity. Once this is completed, the user and merchant execute their swap, with Bitcoin from the user transferring to the merchant, and WBTC from the merchant transferring to the user.

Synthetix

Not to be mistaken with Synthetic tokens, Synthetix is a decentralized platform powered by the Ethereum blockchain that specializes in the creation of Synths: on-chain synthetic assets that track the value of real-world assets.

Being one of the few DeFi projects fluded by institutional investors, Synthetix sits on the 4th spot in terms of market capitalization, only behind MakerDAO, Aave, and Compound, which all specialize in lending.

At the moment, the Synthetix platform offers more than 30 Synths pegged to fiat currencies, commodities, stocks, indices, cryptocurrencies, and other digital assets, while it plans on introducing derivatives as well.

It should be clear why institutional investors would roll with Synthetix, considering the number of traditional investment assets represented by the platform. At the same time, anyone can generate a Synth, by locking SNX (Synthetix’ native currency) and ETH as collateral, similar to how DAI is being generated.

Besides offering Synths, the Synthetix platform has its own decentralized exchange where traders can swap their digital assets. By paying fees to the network, traders compensate SNX hodlers for their contribution to Synthetix’ integrity.

Keep in mind: Half Of All The Ethereum Mined So Far In 2020 Snatched By Grayscale

Additional Tools Set To Help You Navigate The Scene

Putting aside all the interesting projects in the scene, you can find a vast number of DeFi tools, educative documentation, explainer videos and guides that will help you grasp the concept of Decentralized Finance and get started as a user, developer, or business.

I’ve made up this list out of personal experience, but each one of them should be also subject to further networking:

RadarRelay Explainers

0x Docs

DeFi Trackers

If you’re already into DeFi, or you’re intrigued to investigate this exponentially growing field of modern finance together, feel free to hit me on Twitter.

The post What Are The Leading DeFi Tools And Services In 2020 appeared first on Cryptos - the latest news in Crypto, Blockchain, and ICO.

from Blockchain – Cryptos – the latest news in Crypto, Blockchain, and ICO https://ift.tt/2XplcUy

No comments